At the beginning of the year, my brother organized a few of us to try to come up with an alternative to #vss365 (in which people wrote a Very Short Story, optionally based on a prompt word, each day of the year). We called our alternative #wss366 (named for wandering.shop, our Mastodon server, and 366 because this year was a leap year).

Although my fiction output hasn’t amounted to as much as I’d like, I have produced some number of #wss366 stories over the course of the year.

Here are my #wss366 stories for last month:

- https://wandering.shop/@philipbrewer/113569299133283221 (this one did very well in terms of likes and boosts)

- https://wandering.shop/@philipbrewer/113484486842591012

- https://wandering.shop/@philipbrewer/113489949535094161

- https://wandering.shop/@philipbrewer/113420864997904075 (this one didn’t do so well, but it’s my personal favorite)

If you do the Mastodon thing at all, I would encourage you to follow the #wss366 hashtag, because there’s been a lot of good fiction posted there all year, and plans are afoot to continue the effort next year, during which the hashtag won’t change, even though it won’t be a leap year.

I guess the other news (that mostly just matters to me) is that my sore right shoulder and right elbow are doing much, much better. The original injury was probably dog-related (letting Ashley yank my arm at angles that injured the joints), and then exacerbated by my sword fighting training, and perhaps my other exercise as well. The primary source of improvement was making a practice of putting Ashley on her leash-wrap, which means she can’t yank nearly as hard on my arm, combined walking her left-handed. I also cut back on sword fighting to just once a week.

Hopefully I’m now up to training the sword fighting two or three times a week, because I’ll do my regular Sunday longsword and rapier classes today, and then join the student group for a “fancy dress” fechtschule on Tuesday, plus I’ve signed up for my group’s workshop Indes-Cember with some invited instructors Saturday. (A fechtschule is a contest with a few restrictions—in particular, only head hits count, so there’s less need to wear protective clothing. The student group is taking advantage of that by encouraging everyone to wear “the most formal thing you own that you are willing to fight in.” At least two women have said they’ll be wearing heels for as long as they can stand it.)

Inflation and interest rates in 2025 and beyond

Let me start by saying that, judging from his previous term, most of what the incoming president says has no particular bearing on what he’s going to do. But I think a few trends look likely enough that it’s worth thinking about the results on the dollar’s value.

The things I’m thinking of are tariffs and tax cuts, which I expect to lead to higher inflation and larger deficits, both of which will lead to higher interest rates.

Tariffs

The president can impose tariffs on his own, with no need for congressional action. Whether we’ll get the proposed 60% tariffs on Chinese goods, or whether that’s just a bargaining chip, I have no idea. But I think some amount of tariff increase will be imposed, which will feed through directly to higher prices.

That’s not to say that tariffs are necessarily bad (although usually they are). But they do feed through to higher prices.

Tax cuts

Tax cuts need to get through Congress. If the Republicans get the House as well as the Senate, it’s highly likely that legislation will preserve the 2017 tax cuts set to expire next year, and probably some additional tax cuts, such as a much lower rate on corporate income. It’s also possible that we’ll see the proposals to cut tax rates on tip income and on overtime pay enacted, although I doubt it. (The incoming president only cares about his own taxes, not about those of random working-class folks.)

The main thing taxes cuts will do is dramatically increase the deficit. The tariffs will bring in some countervailing revenue, but not nearly enough to fill the gap.

Other things that raise inflation and cut revenue

There are all kinds of other proposals that were bandied about during the campaign, such as deporting millions of immigrants, that raise costs both for the government, leading to higher deficits (the labor and logistics both cost money, and not a little) and for employers (they’re employing the immigrants because their wages are lower), which they will try to offset with higher prices.

What this means for our money

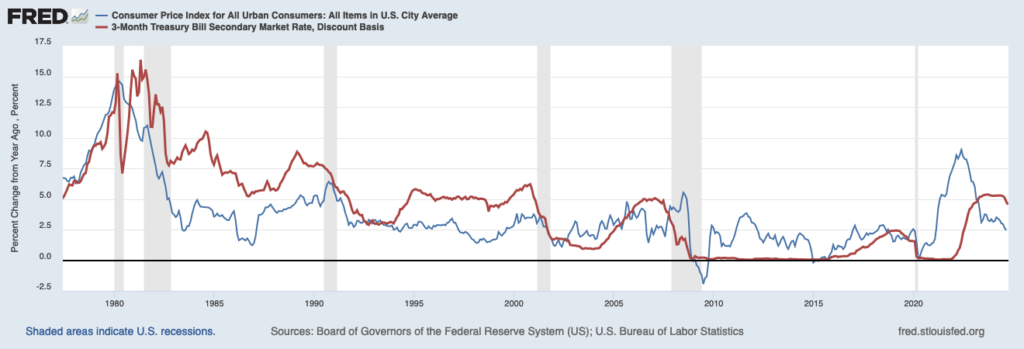

Rising costs will feed directly into higher prices, which is going to look like inflation to the Fed, so I think we can expect short-term interest rates (the ones controlled by the Fed) to get stuck as a higher level than we’d otherwise have seen.

At the same time, lower taxes will mean lower government revenues, leading to larger deficits. For years now, the government has been able to get away with rising deficits, but I doubt if the next administration will have as much success in this area. (Why not deserves a post of its own.)

My expectation is that higher deficits will mean higher long-term interest rates, as Treasury buyers insist on higher rates to reward the risks that they’re taking.

So: Higher short rates and higher long rates, along with higher inflation.

What to do

I had already been expecting inflation rates to stick higher than the market has been expecting, so I’d been looking at investing in TIPS (treasury securities whose value is adjusted for inflation). I’m still planning on doing so, but not with as much money as I’d been thinking of, for two reasons.

First, I’d been assuming that money market rates would come down, as the Fed lowered short-term rates. Now that I think short-term rates won’t come down as much or as fast, I’m thinking I can just keep more money in cash, and still earn a reasonable return.

Second, I’d been assuming that treasury securities would definitely pay out—the U.S. has been good for its debts since Alexander Hamilton was the Treasury Secretary. But the incoming president has very odd ideas about bankruptcy. As near as I can tell, he figures the smart move is to borrow as much as possible, and then declare bankruptcy, and then do it again. It worked for him, over and over again. I’m betting that Congress won’t go along with making the United States do the same, but I’m not sure of it.

Of course, if the United States does do that, the whole economy will go down, and my TIPS not getting paid will be the least of my problems.